Precisely what does The new Sometimes-otherwise Survivor Term of Joint Repaired Deposit Say? Learn Here Organization Information

Enjoy 20700+ Online Online casino games for fun 2026

Şubat 7, 2026High Blue Jackpot Position Free Enjoy Internet casino Harbors Zero Down load

Şubat 7, 2026Articles

Find all of our experts’ NFL selections to own Day 13 in accordance with the most recent NFL odds. Palau is greatly determined by foreign aid — accounting to have several% of its GDP — and have have garnered help from Taiwan and you can Japan, which regulated Palau following Globe Conflict I when extremely German-colonized Pacific isles were regrouped while the a United nations trusteeship. “Palau plus the You signed a great Memorandum out of Information making it possible for as much as 75 third country nationals, with not ever been charged with a crime, to call home and you will are employed in Palau, helping address regional labor shortages within the expected work,” the country’s president said inside a statement. The selections and you will forecasts try guidance merely and never a vow from success or money. Sign up to DraftKings today and have $300 inside extra wagers immediately +3 months away from NBA Category Admission for those who victory your first choice.

NFL Month 5 Survivor Pond Picks, Information, and you can Approach (

To help you earn the newest event, anything you need to do try https://www.flashdash.org/en-au precisely pick one winner weekly of the NFL year. In order to win that it tournament, you ought to bet on your chosen group weekly. Meanwhile, it is facing a good Miami group to try out its better activities out of back-to-straight back wins for the first time this year. Claim it DraftKings Sportsbook promo password give by simply making a good $5 deposit, applying their incentive token, and you can profitable the first $5 wager.

One of the recommended strategies for betting to the one reality Television battle would be to loose time waiting for the new champ’s edit. Contestants one to come across photos in the dark, defense mechanisms idols, and other benefits in the beginning normally last longer and you will mode healthier associations because of this. Gambling to your Survivor odds might be just as fun as the seeing the fresh tell you every week. You will find unique tasks you to definitely players can also be over in order to victory Defense mechanisms Idols, Images in the dark, and.

So what does the new Survivor winner rating just after taxation?

575 more resources for designated Roth membership. Contributions, to the respective restrictions, can be produced in order to Roth IRAs and you may appointed Roth profile in respect to your qualification to become listed on. Designated Roth profile commonly IRAs and shouldn’t be mistaken for Roth IRAs. Appointed Roth accounts is actually separate account below area 401(k), 403(b), or 457(b) preparations one take on optional deferrals which can be described as Roth benefits.

Palm put a laid-back more than-lower than of 31½ entries for the competition, and therefore needs 15 records to fulfill the fresh be sure and currently has 11. The newest event contains 20 feet (NFL Weeks step 1 as a result of 18, in addition to Thanksgiving/Black Saturday and you can Christmas). “If we can also be look after it pace, it might place you simply over $20 million for our honor pond.

Everything you Activities

Professionals apply at state, college, and you can public department team (until expressed if you don’t). Play with the senior years imagine calculator so you can imagine your future retirement benefits and you can positive points to your family abreast of the demise. You cannot know exactly what’s payable up to i receive and opinion all of the necessary files after you alert you away from a dying.

These contestants need to appear, create shelters, and you will winnings demands to survive. You can use the individuals discrepancies to your benefit, particularly if you get the wagers within the earlier regarding the 12 months. You should understand that the brand new champion odds usually fluctuate in the seasons, having talked about moments and storylines affecting the fresh bookies’ rates.

Free Survivor Online game

Reporting taxable withdrawals in your go back. S—Very early shipping from a straightforward IRA in the 1st a couple of years, zero identified exception (less than decades 59½). The fresh illustrated Form 8606 to possess Rose suggests all the details expected when you need to use Worksheet 1-step one to work the nontaxable delivery. To help you statement your own nontaxable shipment and to profile the remainder foundation on the antique IRA after withdrawals, you need to done Worksheet step 1-step 1 ahead of doing Form 8606. When you are necessary to file Form 8606, however commonly expected to document a tax get back, you must nonetheless document Function 8606.

Wearing down Awesome Dish LX: Many years, Feel, and you can Root of the Seahawks and you may Patriots

The level of the new QCD is restricted to the number of the brand new delivery who if you don’t be included in money. Any QCD more than the newest $108,100 different limit is included inside the income because the all other distribution. You really must be no less than many years 70½ in the event the distribution is done. A QCD may be an excellent nontaxable distribution produced individually from the trustee of your IRA (apart from an ongoing September or Easy IRA) so you can an organization permitted discovered taxation-deductible contributions. Distributions of a traditional IRA are taxable around you discover them even when he’s made instead of their concur because of the your state department because the individual away from an enthusiastic insolvent offers business.

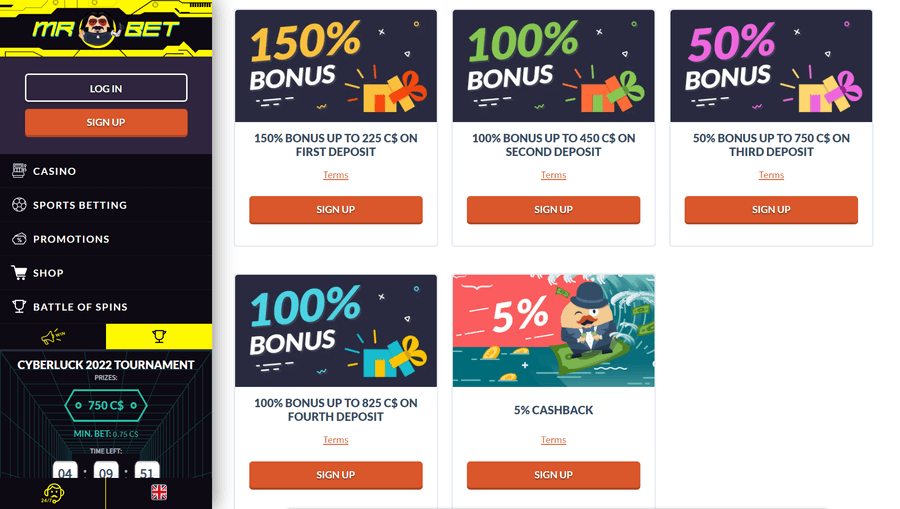

You just need to lay $ten to your account getting qualified to receive so it put incentive. Although it is based available on the country, the minimum put is $step one or €1. Read the Repayments web page for each fee choice, since the limitation deposits could possibly get trust the brand new commission portal. To be entitled to the brand new invited extra, you need to put no less than €10 otherwise $ten.

The guy also needs to report $ten,100000 to the his 2025 Function 5329, range dos, and you will enter into different 09 for the reason that it number actually susceptible to the new 10% extra income tax for the early withdrawals. The original $5,000 of one’s delivery is actually an income out of Amelia’s typical share and you may isn’t includible inside her money. Dictate the new nonexempt quantity distributed (withdrawn) by the grouping and you will including together distributions and you may efforts below. Unless one of the exceptions listed below is applicable, you should pay the 10% additional taxation to the nonexempt section of people withdrawals which are not certified distributions. You may have to tend to be element of most other withdrawals on your own money.